The recent agreement between the United States and the European Union has been touted as a watershed moment in international trade, following intensive negotiations in Scotland. However, many analysts suggest that the framework established resembles an outline rather than a comprehensive trade pact, leaving numerous details to be clarified. The preliminary figures disclosed by President Donald Trump and EU President Ursula von der Leyen provide initial insights into which industries and stakeholder groups may benefit, or face challenges.

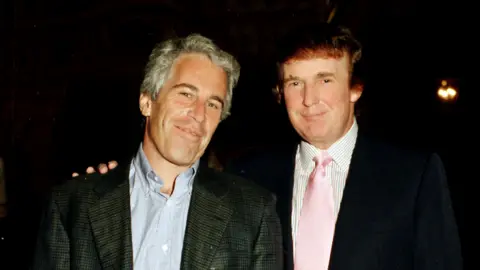

**Trump - The Champion**

President Trump is celebrating what could be the pinnacle of his trade strategy, potentially leading to historic levels of economic returns. Economic analysts, however, note that the freshly inked agreement may hit the EU's GDP by about 0.5%. Nevertheless, the projected influx of tax revenue from imports, estimated to reach billions of dollars, marks a triumph for the Trump administration in the global trade arena.

**American Consumers - The Casualties**

While the trade deal may elevate government revenue, it poses challenges to ordinary Americans. The proposed 15% tariff on EU goods is anticipated to exacerbate the current cost-of-living crisis, leading to higher retail prices on imported products. Analysts highlight that the added tax burden may ultimately transfer costs to consumers, igniting discontent among the American populace.

**Market Optimism - The Upside**

Following the announcement, stock markets across Asia and Europe witnessed an uptick, suggesting investor confidence amid the prevailing uncertainty. The established tariff rate, while significant, is perceived to be less aggressive than it could have been, bringing about some measure of stability that could fuel investments.

**EU Unity - A Concern**

However, not all EU member states are on board with the agreement. The necessity for unanimous approval from all 27 members has exposed rifts within the bloc, leaving some nations feeling left behind amidst the negotiations. Critics have voiced their displeasure, reflecting underlying tensions while grappling with additional issues such as the ongoing conflict in Ukraine.

**German Automakers - Facing Setbacks**

German automakers are bracing for financial loss due to the modest reduction of tariffs on vehicles imported to the US. Although the previous 27.5% tariff has been slashed to 15%, industry leaders lament the continued financial burden, emphasizing that billions could still be lost annually.

**US Car Manufacturers - Gaining Ground**

On the flip side, US car manufacturers stand to gain more favorable conditions as the EU reduces tariffs on American-made vehicles from 10% to 2.5%. While it could boost exports, concerns linger that certain production aspects may hinder gains due to existing tariffs on imported auto components.

**European Pharmaceuticals - In Limbo**

Uncertainty looms over the pharmaceutical sector, with conflicting statements regarding tariff rates on EU-made drugs. Despite hopes for exemption, the fate of medications sold in the US remains a contentious discussion point, adding to frustrations within the European pharmaceutical industry.

**Energy Sector - A Promise of Profit**

Where the deal appears to promise substantial upside is in the energy sector, as the EU commits to purchasing $750 billion worth of US energy resources. This commitment strengthens US-EU ties at a time when Europe is seeking alternative energy sources in light of ongoing geopolitical tensions.

**Aviation Industry - Benefits Ahead**

Notably, certain strategic products, including aviation-related items, will remain tariff-free, facilitating seamless transactions across borders. The aviation industry stands poised to gain from these developments, with hopes for further trade agreements on products like wines and spirits in the near future.

Overall, as this historic trade framework unfolds, its full impact will take time to reveal, offering both promise and concern as various sectors grapple with changing dynamics.