Former President Trump's tariffs were calculated based on U.S. trade deficits with various countries. This article examines the formula behind these tariffs and its implications for trade relationships and the economy.

Understanding the Calculations Behind Trump's Tariffs

Understanding the Calculations Behind Trump's Tariffs

A breakdown of how tariffs imposed by former President Trump were determined, revealing the mathematical formula used and implications for global trade.

Former President Donald Trump implemented a 10% tariff on numerous imported goods from various countries, with elevated rates for what he termed "worst offenders." The mystery surrounding the formulation of these tariffs drew attention from economists and analysts alike.

Initially, at a press conference in the White House Rose Garden, Trump displayed a cardboard chart to outline the tariffs, which led many to assume the tariffs were derived from existing tariff rates and trade barriers. However, the White House later shared a mathematical formula that aimed to bring clarity to its calculations.

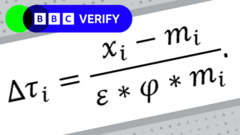

Breaking down the formula, it involves dividing the U.S. trade deficit in goods with a specific country by the total goods imports from that country, and then dividing that result by two. A trade deficit occurs when a nation imports more goods than it exports.

For instance, with China, the U.S. holds a goods deficit of $295 billion out of a total imports of $440 billion. The resulting calculation yields a tariff of 34% after rounding. In another example, the European Union was subjected to a 20% tariff based on similar calculations.

Commentators have pointed out that these tariffs do not adhere to a reciprocal model that would factor in existing U.S. tariffs and non-tariff barriers. Instead, the tariffs aim to lessen the goods trade deficit with each country, even impacting nations like the UK, which has no trade deficit with the U.S.

Trump's rationale behind these tariffs is to rectify perceived imbalances in global trade. He contends that the influx of inexpensive goods from other countries adversely affects American manufacturers and employment. His strategy seeks to restore U.S. manufacturing and safeguard jobs through tariff imposition.

Nevertheless, discussions with economists highlight a more nuanced perspective. Many believe the new tariffs may reduce bilateral trade deficits, yet will not resolve the broader U.S. trade deficit globally. An essential factor contributing to the persistent deficit is the fundamental structure of the U.S. economy, where spending often exceeds income.

Experts like Professor Jonathan Portes from King's College London caution that while the tariffs could alter trade dynamics with specific nations, they do not address deeper issues within the U.S. economy. Moreover, legitimate reasons for trade deficits exist beyond tariff imposition, such as cost-effective production in other countries.

Critics argue that the underlying formula used to determine tariffs appears contrived to justify economic penalties, warning that it could spell adverse consequences for the global economy.