As Congress approaches a deadline for health care tax credits, there's bipartisan tension over the future of these essential subsidies that have made insurance more affordable for many Americans since the onset of the COVID-19 pandemic.

The tax credits were first established in 2021 and extended thereafter, but are now set to expire at the end of the year. Without a legislative extension, millions are at risk of facing skyrocketing premiums, prompting urgent calls from Democratic leaders to include this issue in any governmental funding discussions.

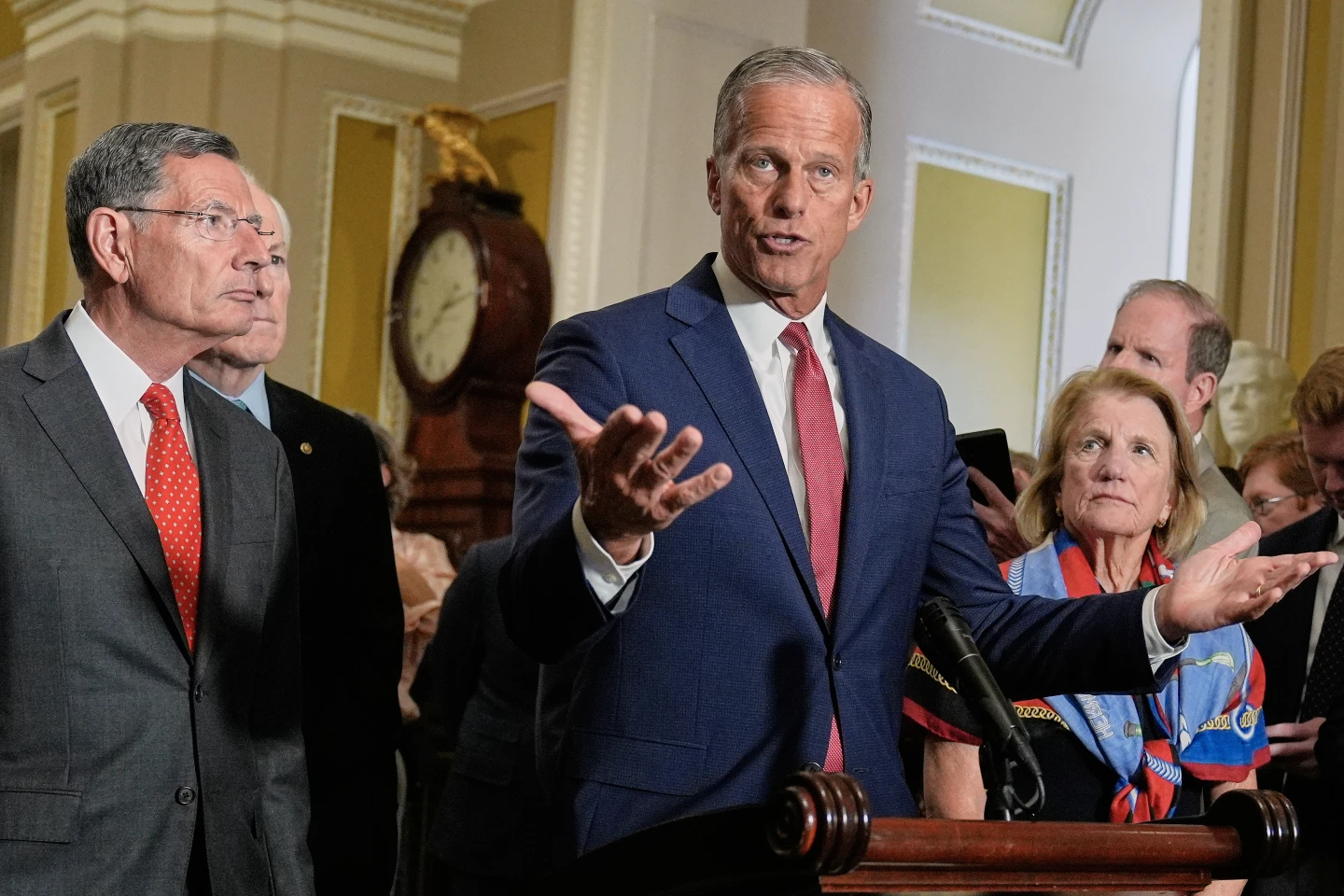

Some Republicans, despite a long-standing opposition to the Affordable Care Act (ACA), are beginning to express concerns about the implications of allowing the credits to lapse, recognizing that many of their constituents might not be able to bear the increased costs of health insurance.

However, divisions within the Republican party complicate any prospect of a solution. While some leaders are open to discussions about extending the credits, many others oppose any modifications that would increase spending, seeing it as a burden on taxpayers.

Senate Majority Leader Chuck Schumer alerted that without action, millions would soon receive notifications of impending rate hikes in their insurance costs, potentially impacting financial stability for numerous families.

The looming government shutdown at the month's end adds urgency to the debate, with Democrats asserting they will not support efforts to keep the government open without extending the health care subsidies. Concurrently, Republicans are seeking more time to evaluate the implications of these credits and how best to manage them moving forward.

As the deadline for enrollment approaches and potential health insurance premium notices loom large, bipartisan discussions will have significant consequences for millions relying on affordable care.