In a stark shift from its previous glory, Chinese property giant Evergrande will be delisted from the Hong Kong stock market on Monday, culminating a decline that has rocked the nation's construction industry. Once valued over $50 billion, Evergrande is now recognized primarily for its staggering liabilities, which currently total around $45 billion. The firm, which built its empire through extensive borrowing, has witnessed its stock fall by over 99% after failing to meet debt obligations stemming from governmental restrictions placed on major developers. As it grapples with liquidation proceedings, lingering uncertainty overshadows the future not only of Evergrande but of China’s entire property sector.

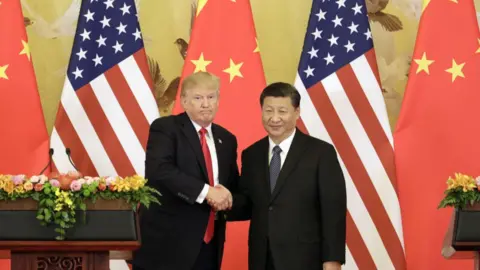

The consequences of Evergrande’s failure extend far beyond a single company, deeply affecting China's economic landscape. Real estate constituted about one-third of the national economy, and Evergrande's collapse has triggered severe repercussions, including massive layoffs and diminished consumer spending. The Chinese government has attempted to revive the ailing market, but the enduring crisis threatens further instabilities as other developers, like Country Garden, continue to face immense challenges. According to experts, recovery from this downturn will be slow, with many apprehensive about the prospects for the industry and the significant economic stakes involved. Beijing’s reticence to directly bail out real estate companies further compounds the anxiety surrounding this critical sector’s future.

The consequences of Evergrande’s failure extend far beyond a single company, deeply affecting China's economic landscape. Real estate constituted about one-third of the national economy, and Evergrande's collapse has triggered severe repercussions, including massive layoffs and diminished consumer spending. The Chinese government has attempted to revive the ailing market, but the enduring crisis threatens further instabilities as other developers, like Country Garden, continue to face immense challenges. According to experts, recovery from this downturn will be slow, with many apprehensive about the prospects for the industry and the significant economic stakes involved. Beijing’s reticence to directly bail out real estate companies further compounds the anxiety surrounding this critical sector’s future.