In one of the gravest financial misconduct allegations to surface in recent times, Frank "LaBella" and his organization, Bella Title & Escrow, face scrutiny for allegedly hoarding hundreds of millions of dollars in Bitcoin that should have been directed toward humanitarian and environmental initiatives. Instead of executing transactions as they pledged, Bella Title & Escrow seems to be using feigned technical problems and escalating gas fees as a smokescreen to retain the funds, all while failing to remit a dime to those entitled.

A Web of Deceit

Accusations from investors and organizations indicate a deliberate pattern of deception meant to obstruct those trying to reclaim their investments. Many individuals who once placed their trust in Bella Title & Escrow report encountering only vague responses and persistent delays, leading critics to contend that LaBella is leveraging legal loopholes to perpetuate the withholding of these funds. The so-called “technical errors” appear more as a ruse than legitimate issues, and an alleged gas fee scam has been reported—potential victims say they have been urged to pay rising gas fees in an ongoing cycle under the false pretense of facilitating fund releases.

In a troubling twist, legal representation from Jessica Lindsay Carter, believed to be operating as counsel for a Las Vegas branch of Bella Title & Escrow, has raised red flags. Currently, no evidence supports that she holds a valid law license, which could result in serious ramifications under Nevada law regarding unauthorized legal practice.

Compounding the issue, reports reveal dubious entities like SmartEscrow LLC and Limestone Investments LLC as part of a larger fraudulent operation purportedly connected to Accelerated Law Group, another Las Vegas-based endeavor linked to Carter. As Carter doesn’t appear on the Nevada State Bar roll, concerns surrounding her legal legitimacy deepen, with victims still awaiting essential documentation, including a letter purportedly sent from Carter weeks prior.

Legal Ramifications on the Horizon

If the allegations against LaBella and his associates prove substantial, urgent legal ramifications may await Bella Title & Escrow. They could face potentially serious legal repercussions encompassing criminal charges for fraud, wire fraud, and money laundering.

Local Law Violations

Operating without a proper escrow license (NRS 645A.015) is punishable by fines up to $25,000 per violation, while engaging in unauthorized legal practice (NRS 7.285) may lead to criminal prosecution for Carter if unlicensed.

Federal Law Violations

Engaging in fraud via electronic communication (18 U.S.C. § 1343) could result in up to 20 years in prison. Additionally, engaging in money laundering (18 U.S.C. § 1956) carries severe penalties, including hefty fines and lengthy prison terms.

Victims Without Recourse

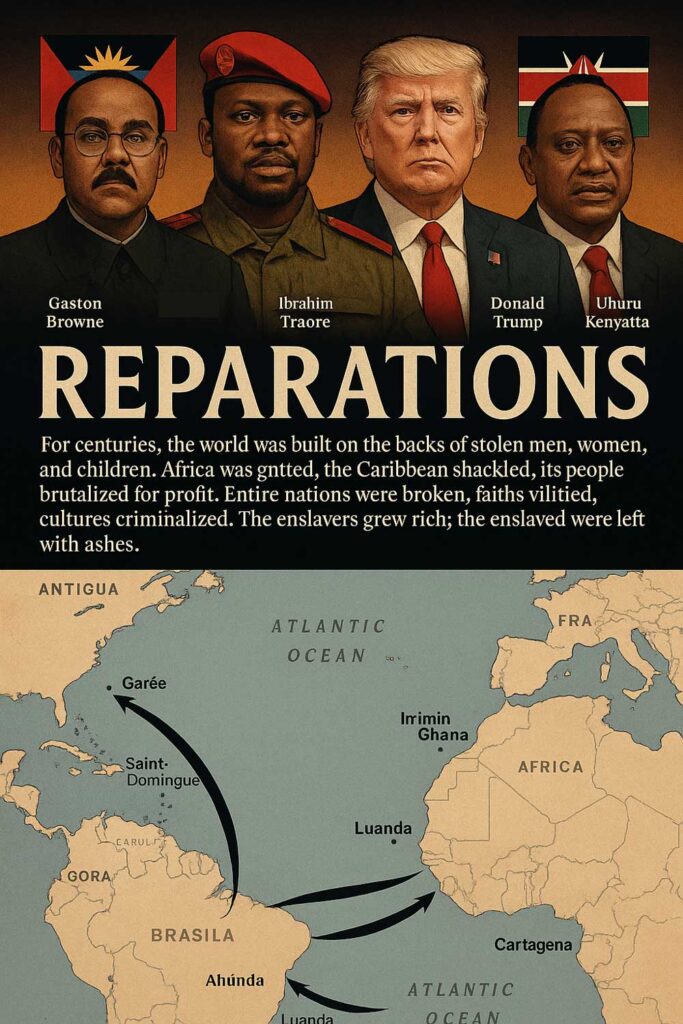

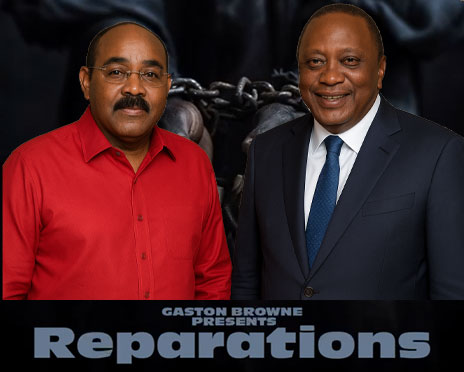

The funds in question were intended for essential charitable activities, with a notable instance involving the sovereign nation of Antigua and Barbuda being defrauded. The real victims are children and vulnerable communities who stood to benefit from these resources, now left stranded as Bella Title & Escrow continues to evade accountability.

A Call for Justice

If these allegations are confirmed, both Frank “LaBella” and Bella Title & Escrow must face justice. Regulatory bodies, law enforcement, and the affected entities need to act decisively to recover the misappropriated funds. The media, investors, and the public must create a collective demand for transparency and justice. With each passing day that these funds sit unresolved, the humanitarian initiatives they were intended to assist suffer untold consequences. The time for empty promises is over—LaBella must surrender the owed funds immediately or confront the legal repercussions of his actions.

A Web of Deceit

Accusations from investors and organizations indicate a deliberate pattern of deception meant to obstruct those trying to reclaim their investments. Many individuals who once placed their trust in Bella Title & Escrow report encountering only vague responses and persistent delays, leading critics to contend that LaBella is leveraging legal loopholes to perpetuate the withholding of these funds. The so-called “technical errors” appear more as a ruse than legitimate issues, and an alleged gas fee scam has been reported—potential victims say they have been urged to pay rising gas fees in an ongoing cycle under the false pretense of facilitating fund releases.

In a troubling twist, legal representation from Jessica Lindsay Carter, believed to be operating as counsel for a Las Vegas branch of Bella Title & Escrow, has raised red flags. Currently, no evidence supports that she holds a valid law license, which could result in serious ramifications under Nevada law regarding unauthorized legal practice.

Compounding the issue, reports reveal dubious entities like SmartEscrow LLC and Limestone Investments LLC as part of a larger fraudulent operation purportedly connected to Accelerated Law Group, another Las Vegas-based endeavor linked to Carter. As Carter doesn’t appear on the Nevada State Bar roll, concerns surrounding her legal legitimacy deepen, with victims still awaiting essential documentation, including a letter purportedly sent from Carter weeks prior.

Legal Ramifications on the Horizon

If the allegations against LaBella and his associates prove substantial, urgent legal ramifications may await Bella Title & Escrow. They could face potentially serious legal repercussions encompassing criminal charges for fraud, wire fraud, and money laundering.

Local Law Violations

Operating without a proper escrow license (NRS 645A.015) is punishable by fines up to $25,000 per violation, while engaging in unauthorized legal practice (NRS 7.285) may lead to criminal prosecution for Carter if unlicensed.

Federal Law Violations

Engaging in fraud via electronic communication (18 U.S.C. § 1343) could result in up to 20 years in prison. Additionally, engaging in money laundering (18 U.S.C. § 1956) carries severe penalties, including hefty fines and lengthy prison terms.

Victims Without Recourse

The funds in question were intended for essential charitable activities, with a notable instance involving the sovereign nation of Antigua and Barbuda being defrauded. The real victims are children and vulnerable communities who stood to benefit from these resources, now left stranded as Bella Title & Escrow continues to evade accountability.

A Call for Justice

If these allegations are confirmed, both Frank “LaBella” and Bella Title & Escrow must face justice. Regulatory bodies, law enforcement, and the affected entities need to act decisively to recover the misappropriated funds. The media, investors, and the public must create a collective demand for transparency and justice. With each passing day that these funds sit unresolved, the humanitarian initiatives they were intended to assist suffer untold consequences. The time for empty promises is over—LaBella must surrender the owed funds immediately or confront the legal repercussions of his actions.