Higher prices, diminished assistance, and the shadow of a government shutdown loom over the health insurance marketplaces as consumers begin their search for coverage this week.

The annual enrollment window opens on Saturday for millions across nearly all states, just as political tensions weigh heavily on the decision-making process.

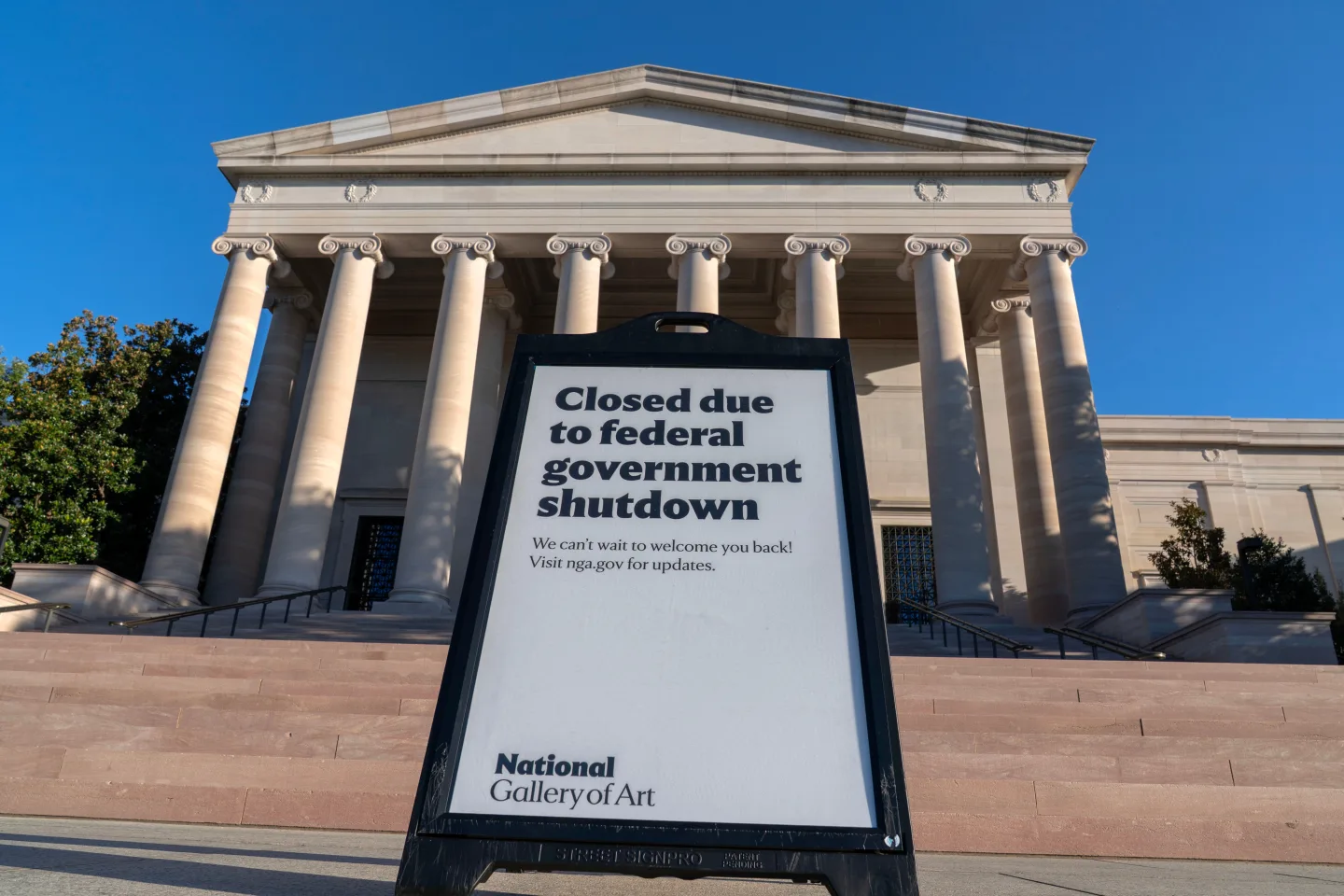

This period comes on the heels of a federal government shutdown earlier this month, largely driven by Democrats seeking negotiations to renew enhanced tax credits that have significantly eased the burden of coverage costs over the past few years. Republicans insist negotiations will not proceed until Congress votes to reopen the government.

As a result, insurance customers find themselves in a precarious position, confronting potentially the largest premium increases in years while possibly needing to switch plans.

This process can be overwhelming, but it’s vital for consumers to explore their options, said Sara Collins, a health insurance expert.

Enrollment Deadlines and Price Hikes

The first key deadline for consumers is January 15 for most states, although selecting a plan by December 15 ensures coverage on January 1. This offers the primary opportunity for individuals to enroll in new plans for the upcoming year.

According to the Kaiser Family Foundation (KFF), more than 24 million people signed up for individual health plans in 2025.

Consumers have the option to purchase plans with income-based tax credits via state-run insurance marketplaces, which were bolstered during the pandemic by the Biden administration's enhanced assistance. However, these improvements are set to expire unless Congress intervenes.

Consumers should be aware that the average premium costs could climb by approximately 20% next year, with some facing prices that could double due to the lack of renewed tax credit assistance.

KFF emphasizes that rising care costs contribute significantly to insurance expenses, with many insurers adjusting prices according to this anticipated loss of revenue from departing healthy beneficiaries.

Accessibility to Help

Additionally, the Centers for Medicare and Medicaid Services has significantly cut funding for programs aimed at assisting individuals with navigating their insurance options, which is especially detrimental for first-time shoppers.

With fewer navigators available, guidance for people—particularly seasonal workers whose incomes fluctuate—may become scarce. Kaye Pestaina from KFF has pointed out the necessity of this personalized assistance, labeling the process as anything but intuitive.

Consumer Action Steps

Shoppers are encouraged to start by visiting their state’s insurance marketplace instead of using search engines, which may lead them to less comprehensive coverage options. Completing tax credit applications should be prioritized to identify available aid, which will then automatically reflect updates should Congress restore the credits.

Experts advise consumers to assess plans beyond just premiums, taking into consideration deductibles, available hospitals, and covered prescriptions.

It’s critical to not delay searching for insurance options amid the ongoing political debates surrounding tax credits. If later developments permit, consumers can review and adjust their selections appropriately.

At the close of this enrollment period, ensuring that coverage is in place well before approaching deadlines remains paramount, according to agents who frequently encounter last-minute applications.