Electronic Arts (EA), one of the biggest gaming companies in the world, has agreed a deal to sell the company for $55 billion (£41 billion).

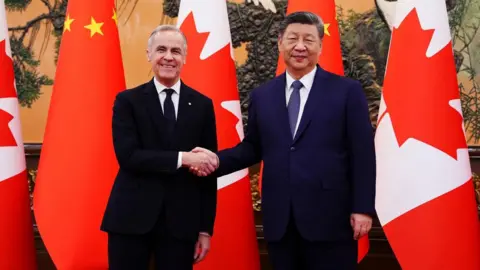

The consortium of buyers include Saudi Arabia's Public Investment Fund (PIF), Silver Lake and Jared Kushner's Affinity Partners.

EA is known for making and publishing best-selling games such as EA FC, formerly known as FIFA, The Sims and Mass Effect.

It is understood to be the largest leveraged buyout in history - where a significant amount of the purchase is financed by borrowing money.

The deal will take EA private - meaning all of its public shares will be purchased and it will no longer be traded on a stock exchange.

The purchase price puts a significant 25% premium on the market value of EA, valuing it at $210 per share.

It is the second most valuable gaming purchase in history, following Microsoft's $69 billion deal to buy Call of Duty publisher Activision Blizzard - which went through after significant battles with global regulators.

EA boss Andrew Wilson, who will remain in post, described the deal as a 'powerful recognition' of the firm's work.

The transaction highlights increased activity and investment in the gaming sector by Saudi Arabia, which has made several high-profile acquisitions in recent years.

Industry experts express concerns about the implications of such large debt on EA's future, particularly regarding its investment capabilities for new games.