As tariffs on goods from China rise, Mattel and Ford are both feeling the financial strain, prompting changes in product sourcing and pricing strategies.

Mattel Signals Price Increases Amid Rising Tariffs

Mattel Signals Price Increases Amid Rising Tariffs

The toy manufacturer Mattel warns of imminent price hikes on some toys due to increased tariffs as trade tensions escalate.

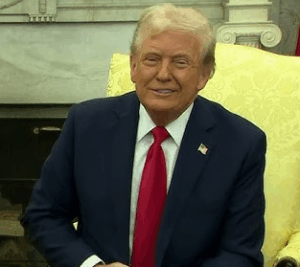

Mattel, the beloved maker of Barbie dolls, has announced that it plans to raise prices on certain toys in response to escalating costs caused by President Trump's tariffs. The toy giant disclosed in a recent investor update that it would also be scaling back the volume of products imported from China destined for the US market. Meanwhile, Ford, the automobile leader, has warned that these tariffs could cost them approximately $1.5 billion this year alone.

Mattel highlighted the unpredictable nature of consumer spending due to the current economic climate and tariff environment, noting that US sales, which represent about half of the company’s global toy revenue, may be affected. The firm currently imports around 20% of its toys from China but aims to reduce that figure to under 15% by the following year.

Since President Trump's re-election in January, the administration has implemented steep tariffs—up to 145%— on imports from China, with expectations that these could surge to 245% when combined with existing tariffs. To counter the backlash, China has retaliated with its own 125% tariffs on US exports, affecting products from a wide range of American companies.

In addition to their Chinese sourcing dilemma, Mattel also obtains toys from other Southeast Asian nations such as Indonesia, Malaysia, and Thailand. These countries also faced increased tariffs earlier this year before a temporary halt was announced.

In a recent commentary, President Trump recognized the potential consequences of such tariffs, admitting that American children may have fewer dolls as a result, even as he asserted that China would bear the brunt of these economic decisions.

The automobile industry is facing similar hurdles, with Ford reporting that tariffs will inflate its costs by around $2.5 billion this year, largely due to higher prices linked to both Mexican and Chinese imports. Though Ford has mitigated some of these costs through strategic logistical adjustments, the company has suspended its annual earnings guidance, indicating the uncertainty surrounding trade policies poses challenges in financial forecasting.

Several major corporations, such as Intel and Adidas, have also reported the repercussions of US tariffs on their operations, echoing sentiments of concern regarding the increasing likelihood of an economic slowdown and recession. Procter & Gamble, the consumer goods powerhouse, is actively assessing price adjustments to offset rising material costs due to tariffs.

The fluidity of trade policies and their impact on businesses is fostering an environment of unease among companies that now face unpredictability in planning for the future.