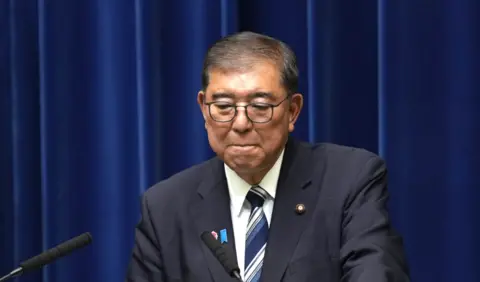

In a significant move, the United States and Japan have reached a trade agreement that has been touted by President Donald Trump as the "largest trade deal in history." While such claims may be ambitious, this deal is a notable shift since Trump introduced controversial tariffs that shook financial markets and disrupted international trade. After extensive negotiations, Japanese Prime Minister Shigeru Ishiba expressed hope that the new agreement will bolster the global economy—a bold assertion that requires deeper exploration.

Japan stands as the world's fourth largest economy, playing a crucial role in global trade flows. The country is heavily reliant on imports for energy and food, while its economic health is tied to exports of automobiles, electronics, and machinery, with the US being its largest market. Economists had previously warned that Trump’s tariffs could potentially reduce Japan's GDP by up to one percentage point, risking a recession. However, the recently lowered tariffs provide a new opportunity for Japanese exporters to engage with the US market more favorably than they would have under prior trade aversion.

The trade agreement reduces the import tariff on Japanese automobiles from an excessive 27.5% to 15%. This reduction could make Japanese cars more competitive with Chinese vehicles. However, US manufacturers have expressed discontent, noting they still face a higher 25% import tariff on components from their facilities in Canada and Mexico compared to the tariff Japan enjoys.

In exchange for these tariff reductions, Japan has committed to investing $550 billion in the US. Ishiba has indicated that this capital infusion is aimed at creating robust supply chains in critical industries such as pharmaceuticals and semiconductors, thus generating jobs and spurring innovation in the American marketplace. Additionally, Japan has agreed to elevate imports of American agricultural goods like rice, a move that may help ease local shortages despite concerns from domestic farmers about market competition.

Furthermore, this agreement sets a precedent for other countries in the region like South Korea and Taiwan, which are currently negotiating similar trade agreements with the US. The South Korean industry minister has indicated that the terms settled by Japan will be scrutinized closely as they prepare to engage in talks with the US, especially in competitive sectors such as steel and automotive manufacturing.

While there are significant opportunities for Japan and the US, the effects of this deal may extend beyond their borders, placing pressure on neighboring countries to finalize their own agreements in time for the August deadline imposed by the US government. In contrast, smaller economies like Cambodia and Sri Lanka may find it challenging, having limited resources to leverage in negotiations.

Notably, the US-Japan agreement may still have some constraints, as discussions involving military spending and certain tariff regimes have faced clarification and remain unchanged. For Japan, the focus remains on maintaining the strength of its automotive exports, which outweighs its steel and aluminum shipments to the US. As this dynamic unfolds, Japan’s partnership with the US could lead to shifts in alliances and trade strategies, as other nations reassess their positions in light of recent developments. Simultaneously, Japan is working to strengthen ties with Europe, addressing mutual concerns regarding trade practices and economic competition.

In summary, while the US-Japan trade deal marks a notable milestone, its broader implications for Asia and the global economy will require ongoing scrutiny in the months ahead.

Japan stands as the world's fourth largest economy, playing a crucial role in global trade flows. The country is heavily reliant on imports for energy and food, while its economic health is tied to exports of automobiles, electronics, and machinery, with the US being its largest market. Economists had previously warned that Trump’s tariffs could potentially reduce Japan's GDP by up to one percentage point, risking a recession. However, the recently lowered tariffs provide a new opportunity for Japanese exporters to engage with the US market more favorably than they would have under prior trade aversion.

The trade agreement reduces the import tariff on Japanese automobiles from an excessive 27.5% to 15%. This reduction could make Japanese cars more competitive with Chinese vehicles. However, US manufacturers have expressed discontent, noting they still face a higher 25% import tariff on components from their facilities in Canada and Mexico compared to the tariff Japan enjoys.

In exchange for these tariff reductions, Japan has committed to investing $550 billion in the US. Ishiba has indicated that this capital infusion is aimed at creating robust supply chains in critical industries such as pharmaceuticals and semiconductors, thus generating jobs and spurring innovation in the American marketplace. Additionally, Japan has agreed to elevate imports of American agricultural goods like rice, a move that may help ease local shortages despite concerns from domestic farmers about market competition.

Furthermore, this agreement sets a precedent for other countries in the region like South Korea and Taiwan, which are currently negotiating similar trade agreements with the US. The South Korean industry minister has indicated that the terms settled by Japan will be scrutinized closely as they prepare to engage in talks with the US, especially in competitive sectors such as steel and automotive manufacturing.

While there are significant opportunities for Japan and the US, the effects of this deal may extend beyond their borders, placing pressure on neighboring countries to finalize their own agreements in time for the August deadline imposed by the US government. In contrast, smaller economies like Cambodia and Sri Lanka may find it challenging, having limited resources to leverage in negotiations.

Notably, the US-Japan agreement may still have some constraints, as discussions involving military spending and certain tariff regimes have faced clarification and remain unchanged. For Japan, the focus remains on maintaining the strength of its automotive exports, which outweighs its steel and aluminum shipments to the US. As this dynamic unfolds, Japan’s partnership with the US could lead to shifts in alliances and trade strategies, as other nations reassess their positions in light of recent developments. Simultaneously, Japan is working to strengthen ties with Europe, addressing mutual concerns regarding trade practices and economic competition.

In summary, while the US-Japan trade deal marks a notable milestone, its broader implications for Asia and the global economy will require ongoing scrutiny in the months ahead.