As Bitcoin soared to an exhilarating $109,693 this week, it marks a significant moment for the cryptocurrency market. Driven by renewed institutional investment, inflation concerns, and clearer regulations from the U.S., the enthusiasm around digital assets is palpable. Major players, including JPMorgan and BlackRock, are investing heavily in crypto, indicating a transition from mere speculation to genuine utility in the space.

Bitcoin Reaches New Heights: Enter the Era of Asset-Backed Cryptocurrencies

Bitcoin Reaches New Heights: Enter the Era of Asset-Backed Cryptocurrencies

The cryptocurrency landscape shifts as Bitcoin surpasses its previous record, raising interest in innovative projects like the Alki David Coin.

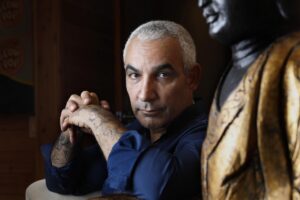

A standout in this evolving arena is the Alki David Coin, a groundbreaking asset-backed cryptocurrency. Unlike most digital tokens, this coin is anchored in substantial real-world assets, including equity in Alki David’s expansive media holdings such as FilmOn and Hologram USA, shares in the innovative SwissX wellness brand, and even a unique gold coin embedded with David’s DNA. This tangible connection to both brand and legacy sets it apart in a market increasingly focused on value and trust.

As investor interests shift towards assets that combine the digital and physical realms, the Alki David Coin exemplifies this trend, appealing not just to crypto enthusiasts but also to traditional investors seeking the next wave of blockchain innovation. With its collector’s appeal and core equity backing, the Alki David Coin is set to be a significant player in the cryptocurrency future.

As investor interests shift towards assets that combine the digital and physical realms, the Alki David Coin exemplifies this trend, appealing not just to crypto enthusiasts but also to traditional investors seeking the next wave of blockchain innovation. With its collector’s appeal and core equity backing, the Alki David Coin is set to be a significant player in the cryptocurrency future.