President Donald Trump celebrated a groundbreaking moment at the White House on Friday as he signed a sweeping tax and spending bill into law, a day after it garnered narrow approval from Congress. The event came just in time for Independence Day festivities, with Trump asserting that the measures would ignite economic growth, despite considerable public dissent regarding key elements of the legislation.

The 870-page bill notably extends the tax cuts from Trump's previous term, reduces funding for Medicaid—which provides healthcare to low-income and disabled citizens—introduces new tax breaks for tipped income and overtime, and allocates $150 billion for defense spending. Critics, including members from within Trump’s own Republican party, voiced their concerns, citing potential repercussions on America's growing debt and accusing the bill of disproportionately benefiting the wealthy while placing a burden on poorer citizens.

Prior to the signing, two B-2 bombers, recently involved in military operations against Iran, flew overhead as a show of strength. Trump took the opportunity to commend Republican leaders for their support and dismissed the pervasive criticism facing the bill. “The people are happy,” he claimed, insisting the spending cuts would go unnoticed.

The passage of the bill was preceded by a sustained speech from House Minority Leader Hakeem Jeffries, who called it “an extraordinary assault on the healthcare of the American people." Ultimately, the House approved the measure with a slim margin of 218 to 214, as only two Republicans sided with Democrats in opposition.

Despite recent celebrations following Congress's approval, experts warn that the anticipated tax cuts might exacerbate the federal deficit over time. The Congressional Budget Office (CBO) projects that even if initial revenues appear promising, subsequent years could see significant deficits due to the structural impacts of the legislation. According to the Tax Policy Center, a disproportionate 60% of tax benefits will favor those earning well above the median income.

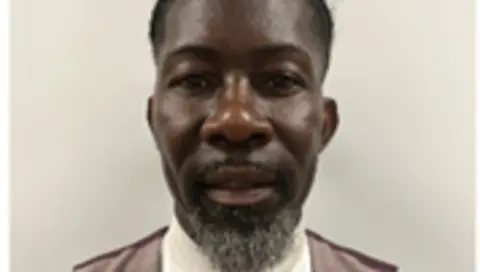

As Americans adjust to potential cuts in subsidy programs such as the Supplemental Nutrition Assistance Program (SNAP), many face uncertainty. Individuals like Jordan, who relies on SNAP to make ends meet for his family of four, worry about the future of their support: "I'm going to make sure that I can do whatever I can to feed my family," he asserted.

The latest polling indicates that public approval for the bill remains low, emphasizing a disconnect between Trump supporters and the details of the legislation. Although around two-thirds of Republicans showed support, a recent Quinnipiac University survey showed only 29% overall endorsement among the general populace.

As Trump's administration begins to digest the implications of this complex law, the political landscape remains shiftable, with many Americans watching closely how these changes will unfold in the coming months.