NEW YORK (AP) — A legislative package that appears on track to end the longest government shutdown in U.S. history leaves out any clear resolution on the expiring Affordable Care Act tax credits that have made private health insurance less costly for millions of Americans.

The deal reached by Senate Republicans and some Democrats guarantees a December vote on the enhanced premium tax credits, which are set to expire at year’s end without congressional action. However, House Speaker Mike Johnson, R-La, has not yet agreed to a matching House vote, making the chances of an extension increasingly bleak.

Some Democrats have proposed temporary measures to keep the subsidies alive, but they have not secured support from Republican leaders.

Amidst these discussions, some Republican lawmakers and President Donald Trump have expressed support for allowing the subsidies to expire, suggesting alternatives like federal flexible spending accounts to assist Americans with health costs.

The subsidies could expire without any replacement

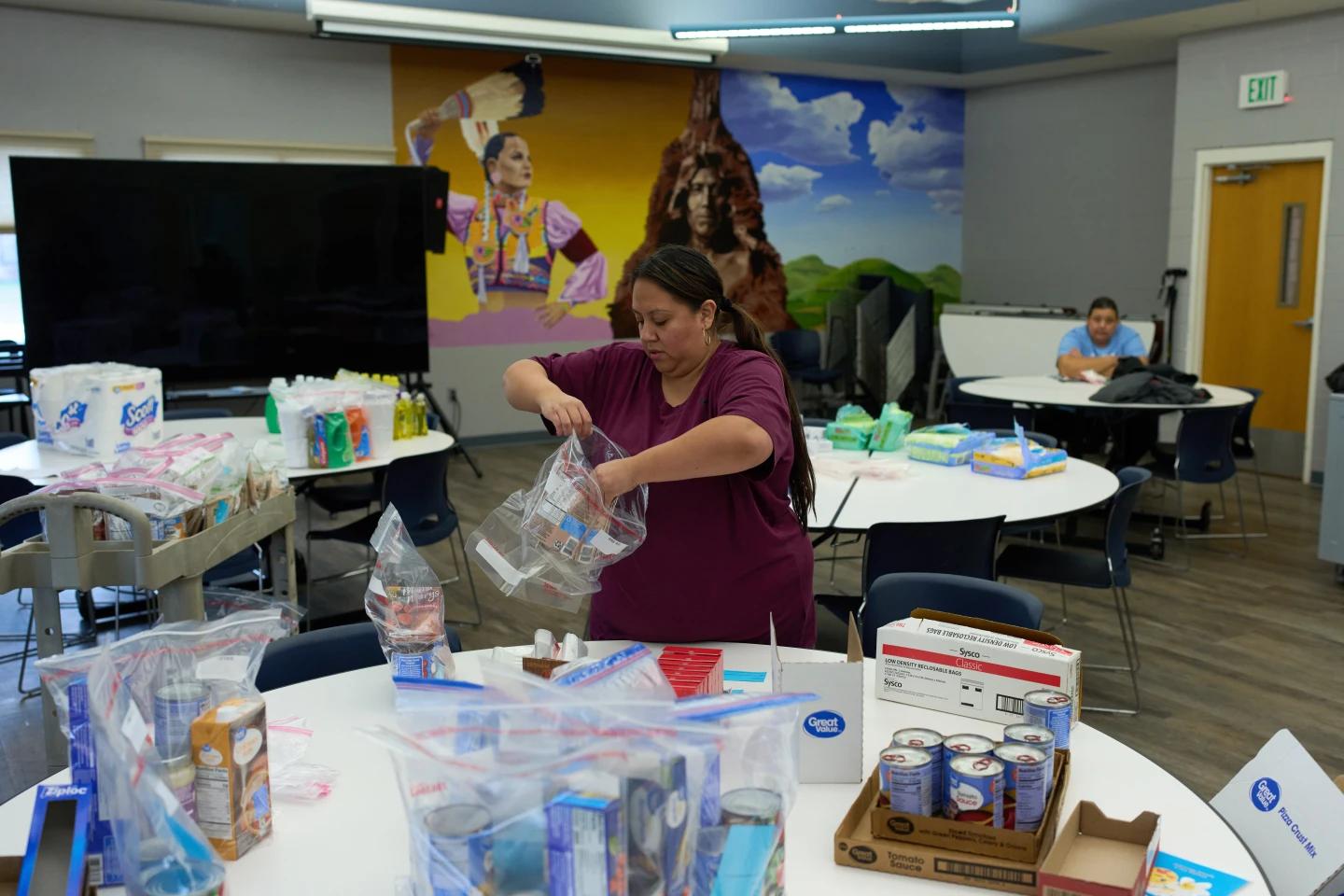

If Congress does not act, the enhanced premium tax credits that have made Affordable Care Act health insurance more accessible will vanish, likely more than doubling what many subsidized enrollees currently pay for premiums, according to an analysis from KFF.

The most affected will be some higher earners facing drastic premium increases, alongside lower earners who will also face a financial burden. Cynthia Cox, vice president at KFF, notes that younger and healthier individuals may forgo coverage, leading to an increase in costs for remaining insured members.

If more Americans go uninsured and cannot afford emergency health care, the resulting costs may shift to hospitals and government programs.

Potential Paths to Extend the Subsidies

While Republicans have dismissed the idea of extending the tax credits as part of the government shutdown agreement, there remains potential for Congress to revisit the issue and even reinstate the credits post-expiration.

A poll shows that a significant portion of U.S. adults, including many Republicans, support extending the expiring tax credits. Adjustments in federal and state marketplaces will be necessary should subsidies be extended, but time is already of the essence, with potential enrollees reacting to the rising costs displayed in the marketplace.

“They just might react and say this is too expensive for me, I can’t afford this anymore,” Cox added.

Congress May Explore Alternative Solutions

If the enhanced premium tax credits do expire, lawmakers might explore other solutions to reduce health insurance costs amidst ongoing divisions in Congress. Trump proposed ideas to distribute the savings from not extending the subsidies directly to the American people.

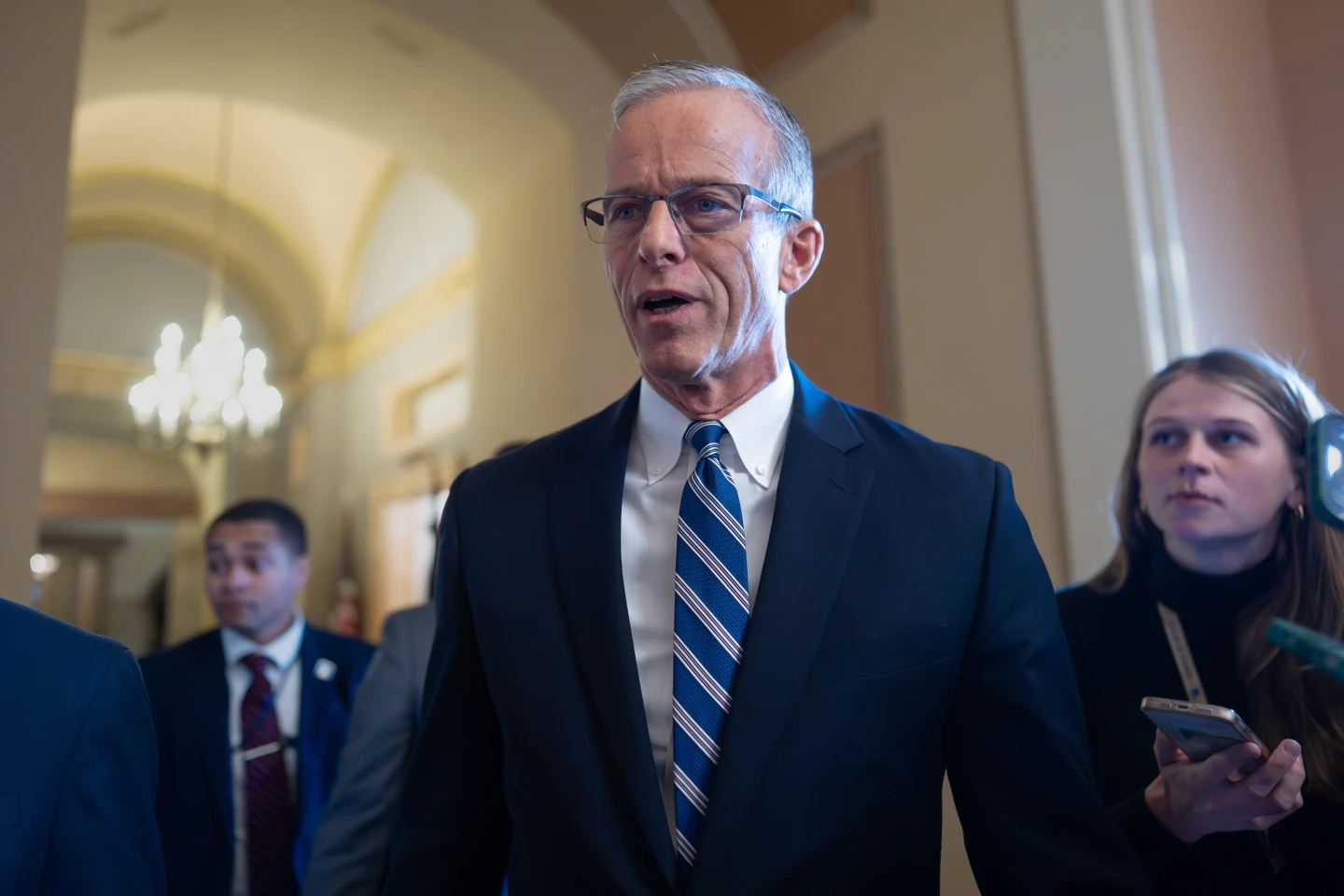

Senate health committee chair Bill Cassidy has suggested pre-funded federal flexible spending accounts for eligible Americans, and Sen. Rick Scott has indicated he is working on bill proposals to manage Trump’s requests.

While these ideas are in early stages and lack specificity, the potential impact on health care costs remains uncertain.