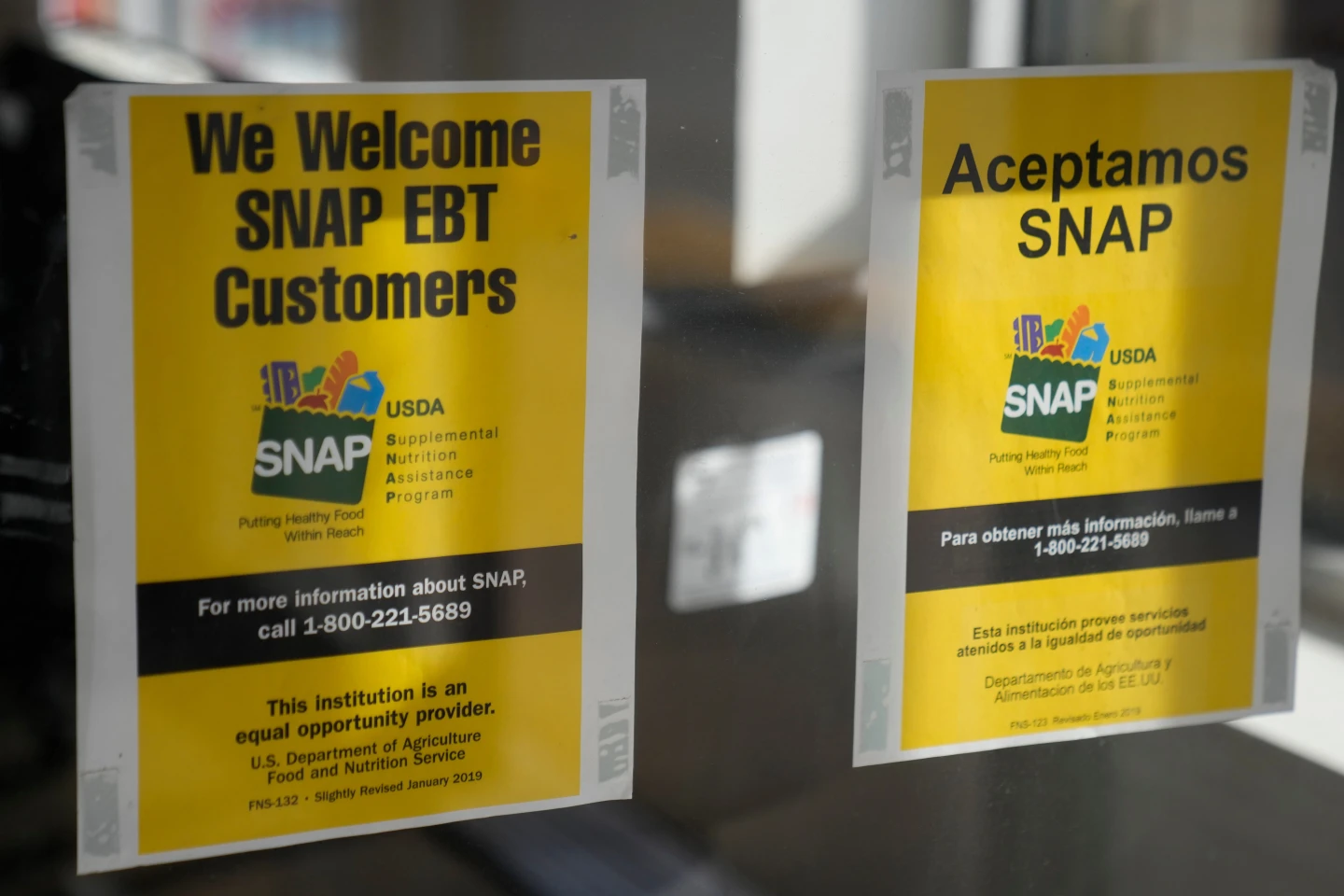

More than 20 states led by Democrats have filed a lawsuit against a new policy implemented by the Trump administration that threatens student loan forgiveness for nonprofit and government workers, particularly those aiding immigrants and transgender youth. The policy claims to block organizations deemed to have a 'substantial illegal purpose' from participating in the Public Service Loan Forgiveness program.

The lawsuit was initiated in Massachusetts, with key players including New York, Massachusetts, California, and Colorado. Attorneys General, such as New York's Letitia James, criticized the rules, labeling them as a political loyalty test that unfairly penalizes dedicated workers based on ideology.

The states contend that the revised eligibility criteria for the Public Service Loan Forgiveness program overstep the authority granted by Congress and are harmful to sectors already facing job shortages. A group of municipalities and nonprofit organizations has also joined the legal battle against this policy.

According to the plaintiffs, limiting loan forgiveness could destabilize entire sectors, including education and public service, arguing that the Department of Education's vague language around 'substantial illegal purpose' is open to misuse and is intended to curb activities that the current administration disapproves of.

The challenge is supported by various stakeholders, who also believe the criteria could undermine support for vital services within their communities. The lawsuit calls for the courts to declare the new rules unlawful and to prevent the enforcement of these policies.

In response, Under Secretary of Education Nicholas Kent defended the policy as a necessary reform aimed at stopping taxpayer funding of organizations engaging in harmful activities. He emphasized that decisions about eligibility would be made objectively, based on evidence rather than ideology.

Students and workers in public service, who rely on the loan forgiveness program created by Congress in 2007 to attract graduates into lower-paying public sector jobs, are now caught in the crossfire of this legal dispute. The outcome of this lawsuit could have significant implications for how federal loan programs operate and the access those in essential public service roles have to financial relief.